Lloyds Bank

Reimagining the Account Opening Experience

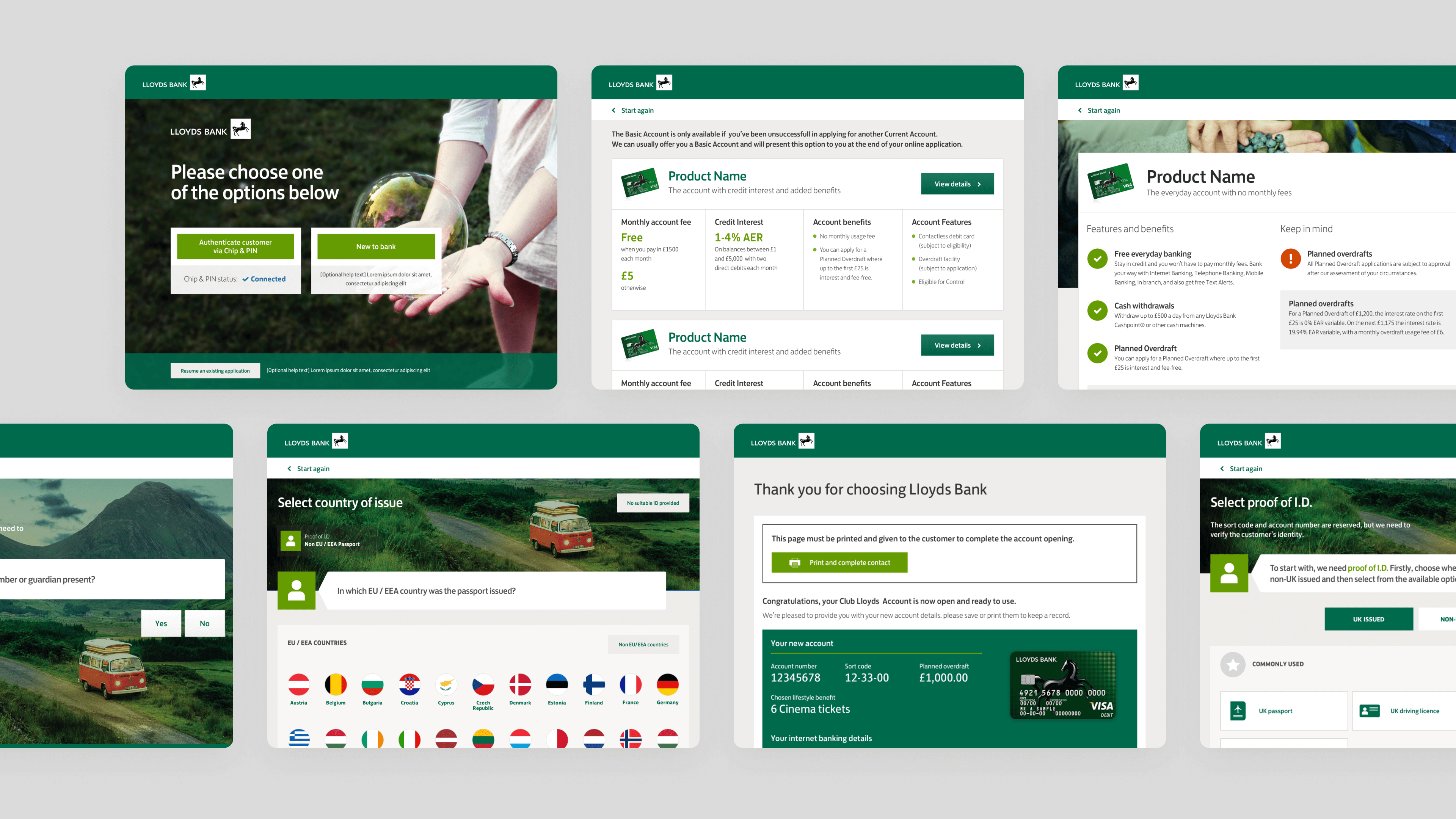

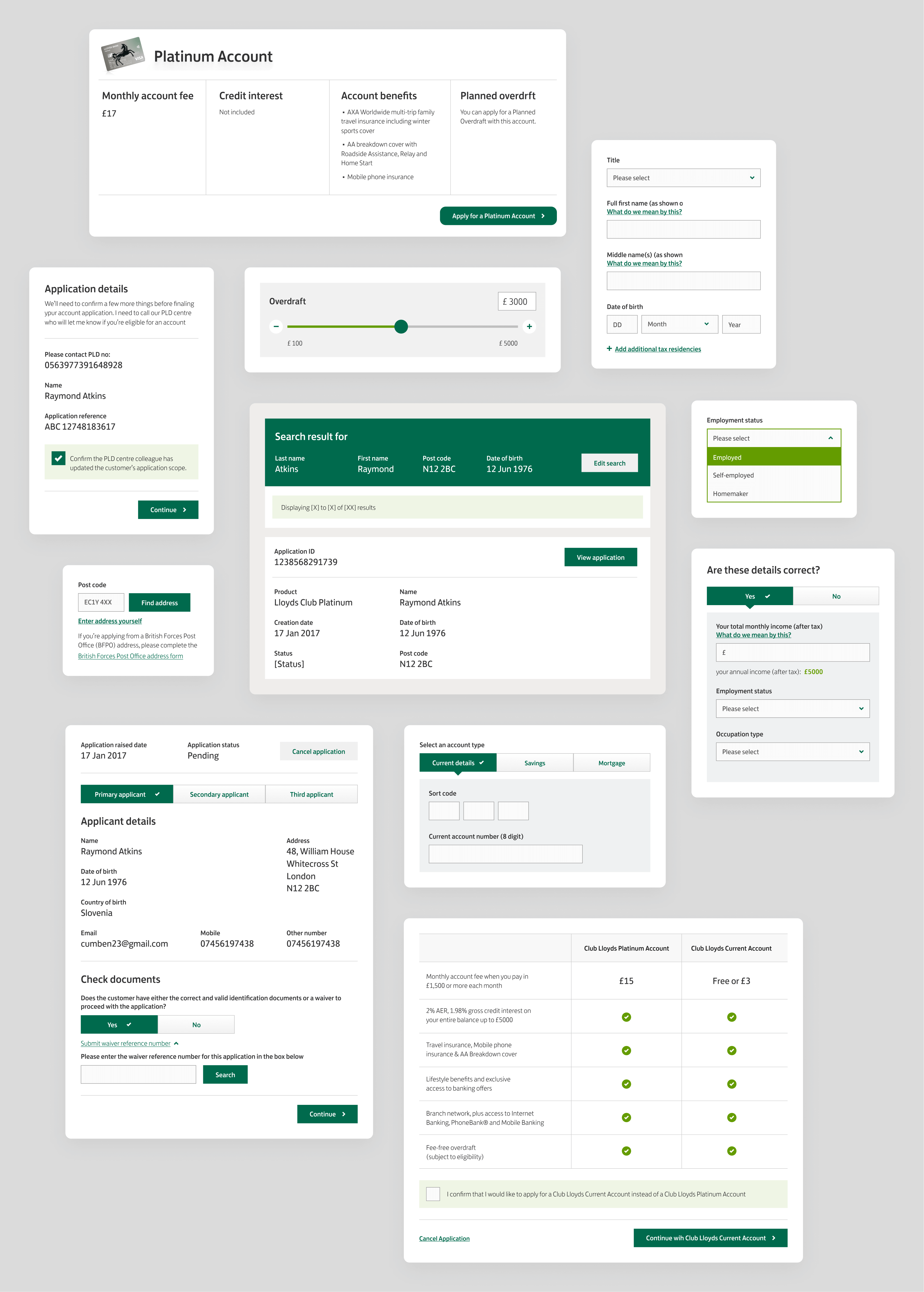

Lloyds Banking Group embarked on a mission to transform its digital services, aiming to modernise the way customers open bank accounts. A key focus was to simplify the in-branch account opening process by replacing traditional methods, reliant on computers, printers, and scanners, with a streamlined, iPad-based system. This shift provided greater flexibility for both colleagues and customers, creating a more efficient and seamless experience.

Year

2016 - 18

Agency

Publicis Sapient

Role

UI Design, Motion Design, Illustration

Awards

FS Tech, 2019 - Partnership of the Year

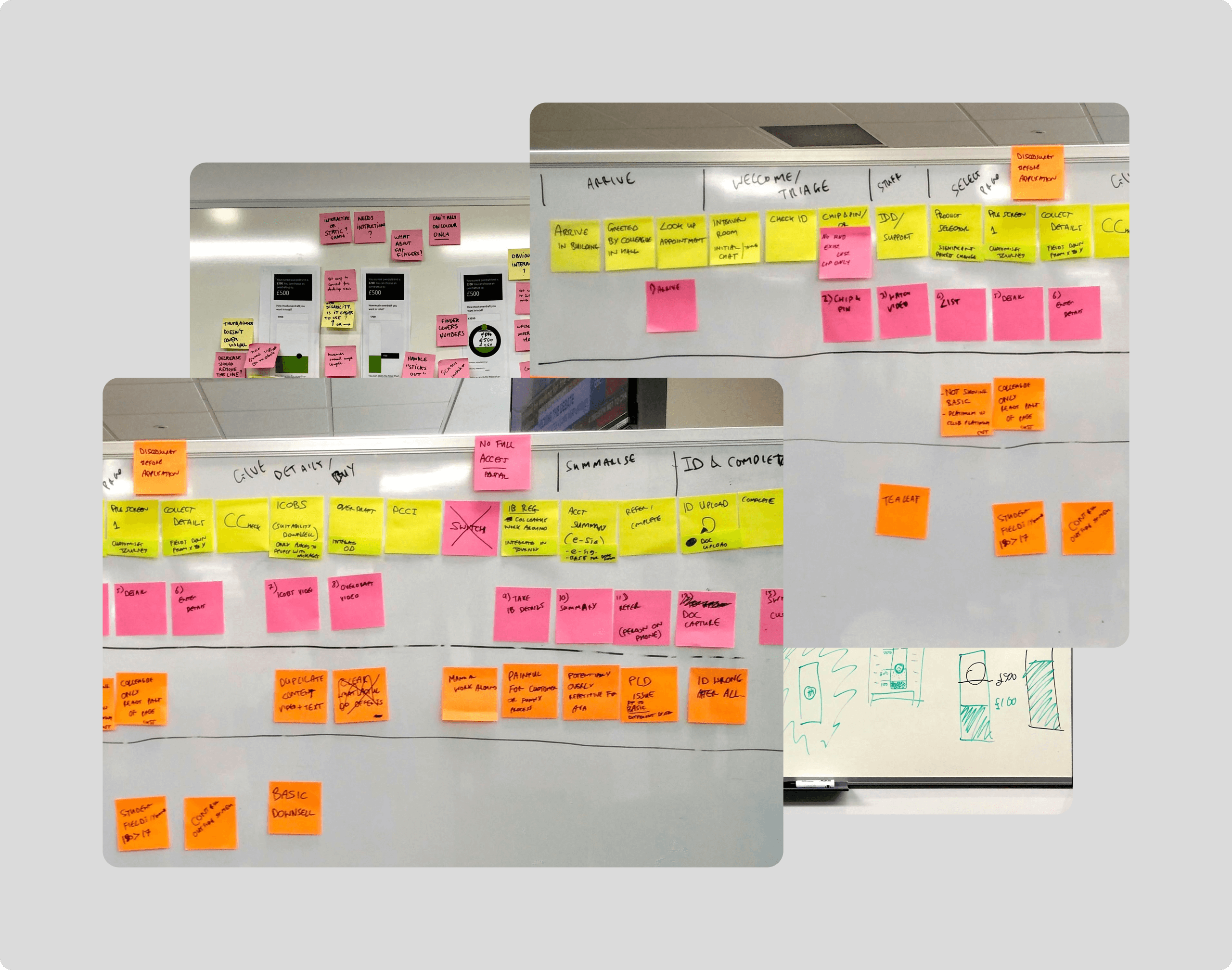

A thorough analysis of the current process was conducted to identify pain points and map opportunities for improvement.

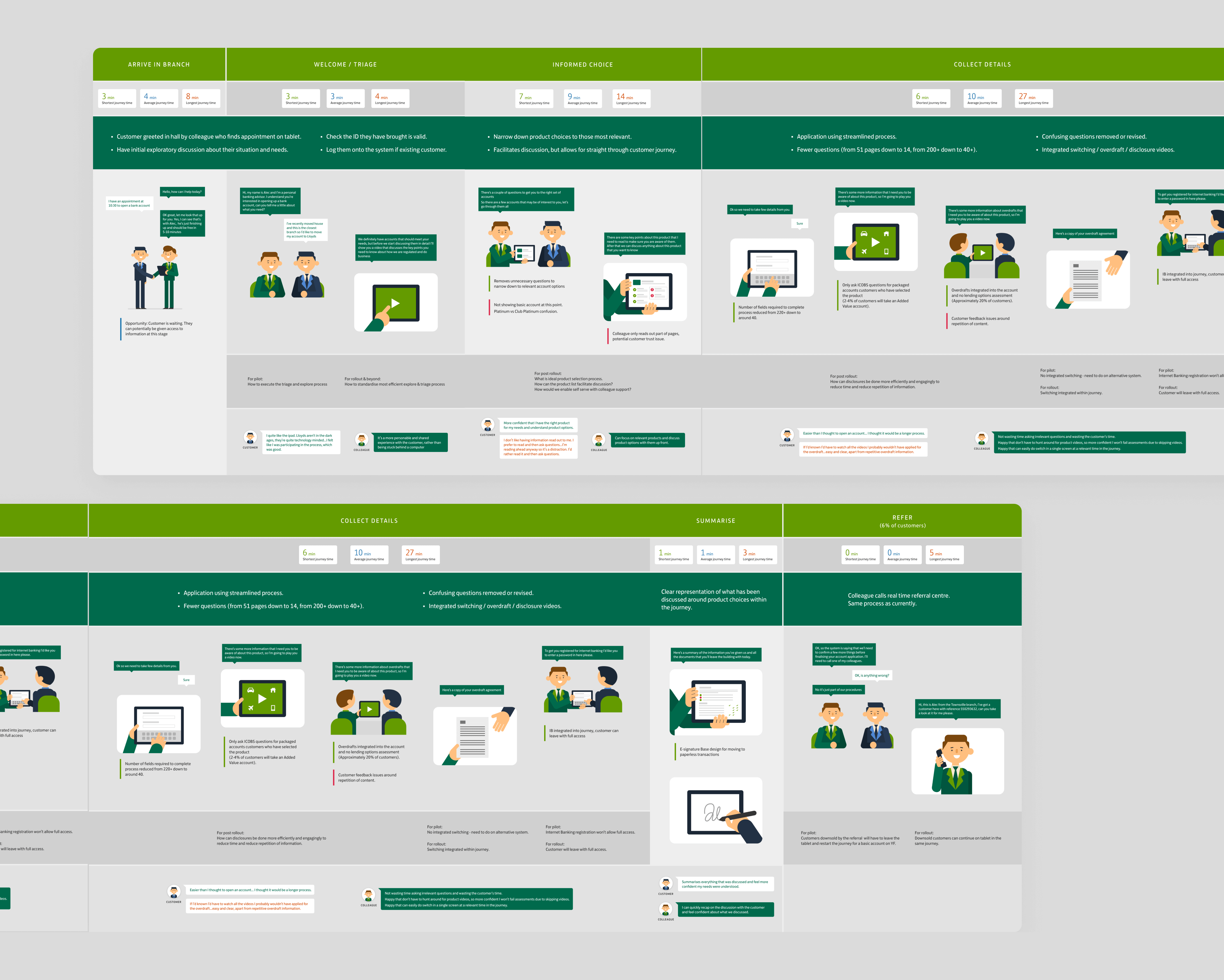

To provide a clearer perspective, the insights from the initial workshop were consolidated and transformed into an illustrative experience map.

The experience map was segmented to highlight digital touchpoints and outline the various stages of the account opening flow. This visualisation provided clarity, enabling the design of an intuitive end-to-end UI journey for the iPad used in branches.

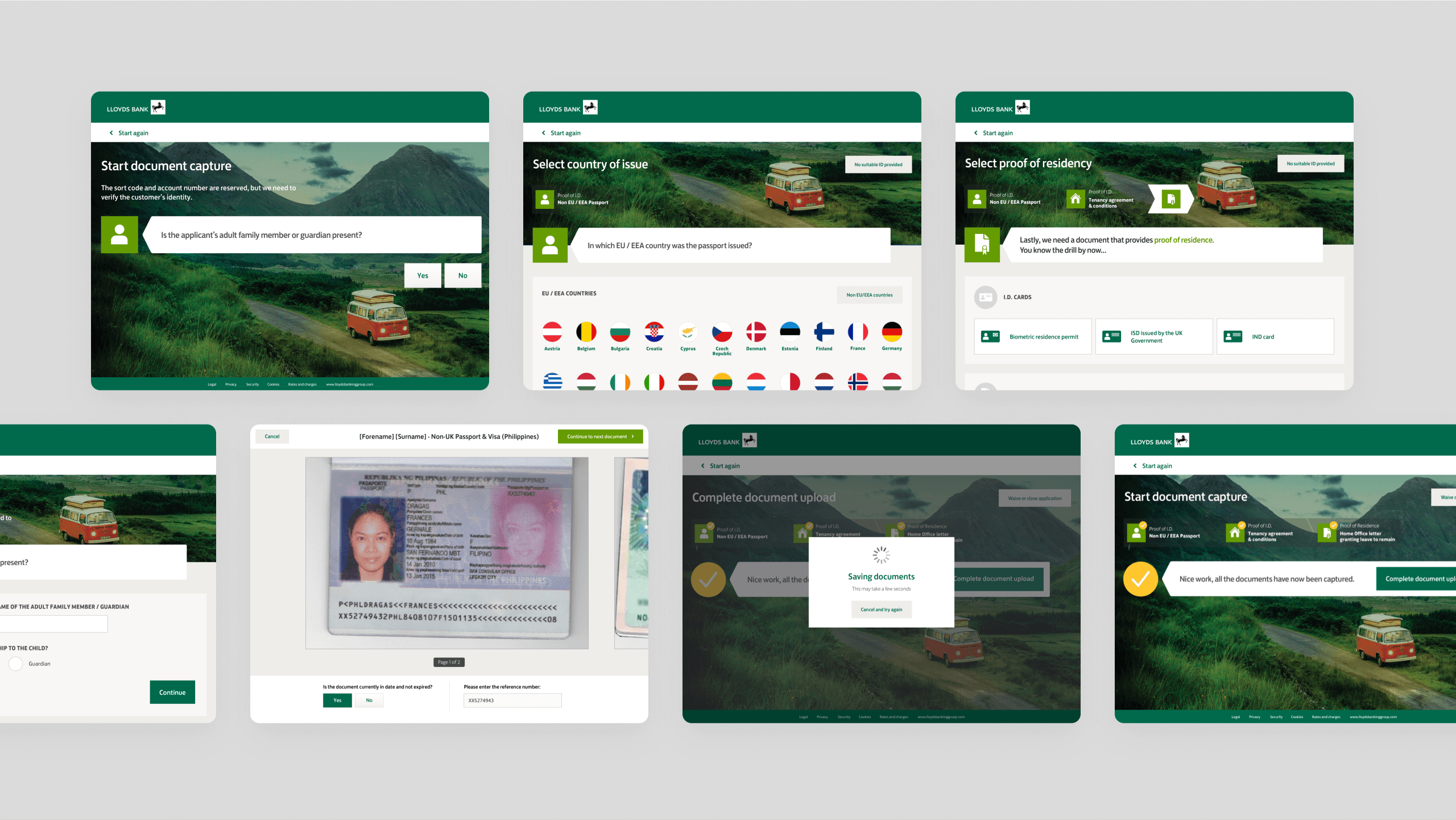

Seamless document capture on iPad

Document capture was a key feature that underwent a major transformation. The traditional desktop-based system was replaced by integrating the native iPad camera app into the custom web application. This innovation eliminated the need for traditional scanners and significantly reduced the overall appointment time for both colleagues and customers.

Introducing informative motion to make things intuitive.

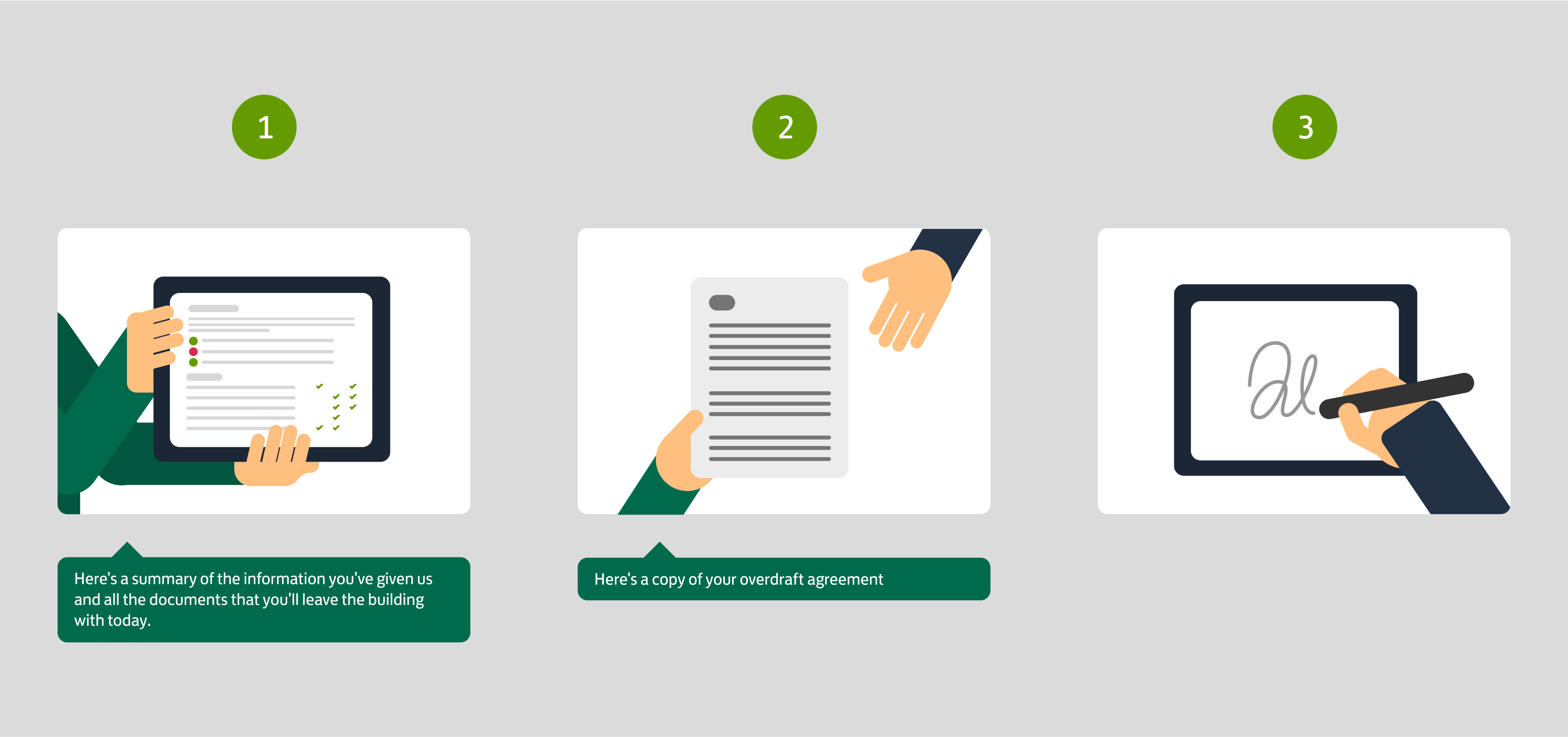

At a key point in the journey, bank colleagues need to hand over the printed draft account agreements to customers before they sign. Ensuring this happens at the right moment was essential for a smooth process.

Research revealed that colleagues were often missing the correct handover moment due to an ineffective checkbox trigger. This presented an opportunity to introduce animation as a subtle reminder for the next action.

Animations were tailored to reflect the distinct brand personalities of Lloyds and Halifax. Lloyds maintained a serious and professional tone, while Halifax adopted a more playful and energetic approach.

Outcome

The impact of the new features was measured after launch. An illustrative chart was created to summarise how the enhancements improved both customer and colleague experiences.

Key milestones

- Transitioned to new technologies for flexibility and consistency across digital and in-branch journeys.

- Reduced appointment times, allowing colleagues to serve more customers.

- Enabled colleagues to use tablets for greater flexibility in customer interactions.

- Established Lloyds Bank branches as showcases for digital banking.